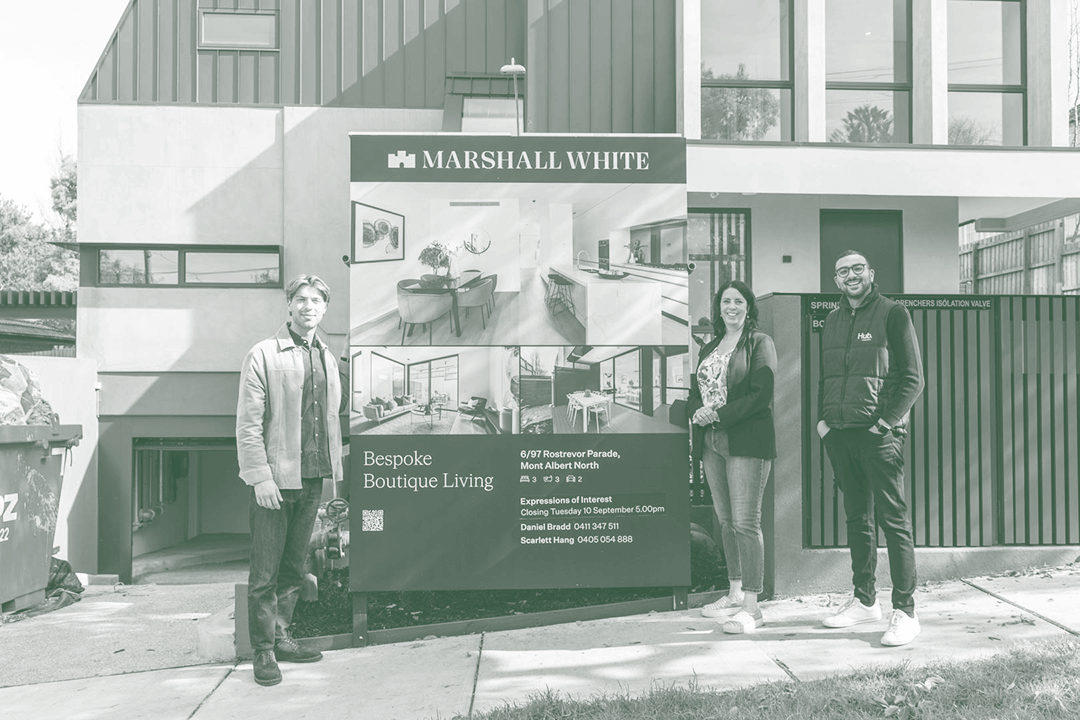

Making it count in Mont Albert North

Senior Development Finance, $7.8m

Case Study by Tommy F

Local Developer

Project Finance

The loans we are proudest of are those that go the distance. For us, nothing better encapsulates this than a boutique townhouse project we have been involved in over the last few years in the leafy suburb of Mont Albert North.

In 2021, via a long-time Jadig partner, Hub Property Group, we were engaged to finance a development site on Rostrevor Parade, Mont Albert North. We assisted with the acquisition finance and provided funding to progress the project through its planning and pre-development milestones.

Later that same year, we rolled our land facility into a construction loan at a competitive 70% LVR. This was an almost $8 million facility, financing the construction of seven quality townhouses.

The ensuing three years were not without their challenges, and a build program that was meant to run slightly over a year ended up running twice as long as expected. This project was certainly not immune to the cost escalations and pressures that afflicted our construction industry. What this meant is that we had to be nimble, pragmatic, and most importantly good listeners.

As a financier, we worked hand in glove with our sponsor group, the project manager Hub, and the builder to negotiate outcomes that allowed for momentum to continue on-site and, ultimately, create win-win solutions in what has been the industry’s most challenging few years in decades.

And guess what? We went the distance. The project achieved its certificate of occupancy early this year and the keys handed over to the incoming purchasers. The remaining stock has been refinanced into a Jadig residual stock facility to give our client the time to either sell or lease the remaining townhouses to the market.

That is what makes us proud – going the distance and staying involved in the full life cycle of the investment and project. From site finance to construction to residual stock, that is the test of a productive relationship between borrower and lender, and it shows that doing the right thing always pays off in the long run.

We’re immensely proud of this project and the challenges that were overcome. It has taught us the value of staying on course and the importance of partnering with credible and capable developers who have the temperament and experience to handle the ups and downs of development.